Ever felt like you’re in a constant tug-of-war with your bank account? You’re not alone. The struggle to save money is real, and it’s a battle that’s fought on multiple fronts: from resisting that tempting online sale to bypassing your favorite coffee shop on your morning commute. But what if I told you there’s a way to turn this financial battlefield into a playground? Yes, you heard it right. By transforming budgeting into a game, you can not only make saving fun but also come out victorious in the war against empty pockets. Intrigued? Let’s dive in.

Understanding the Struggle

Picture this: You’re staring at your bank statement, and it’s a battlefield littered with transactions that make you cringe. “Why did I buy that?” “How did I spend so much on takeout?” Sound familiar? It’s like being stuck in a loop, where your paycheck disappears faster than a scoop of ice cream on a hot summer’s day. But hey, I get it. It’s tough out there. The world is constantly throwing shiny temptations your way, and resisting them feels like trying to swim upstream in a river of molasses.

But fear not, my fellow Millennials and Gen Zers, for there’s light at the end of this financial tunnel. You see, the first step to conquering any challenge is understanding it. And boy, do I understand the struggle. We’re bombarded with advertisements telling us we need this, that, and everything in between to be happy. It’s no wonder we sometimes succumb to the siren call of consumerism. But here’s the kicker: happiness doesn’t come from material possessions; it comes from financial freedom and peace of mind. And that, my friends, is worth fighting for.

So, let’s make a pact, shall we? Let’s acknowledge that saving money isn’t always easy, but it’s always worth it. And together, let’s explore how we can turn this daunting task into a game we can actually win. Ready? Let’s do this.

The Power of Gamification

Now, I know what you’re thinking. “Budgeting? A game? Yeah, right.” But hear me out. Gamification is more than just a buzzword; it’s a powerful tool that taps into our innate desire for competition, reward, and achievement. Think about it. When was the last time you felt a rush of excitement from checking off a task on your to-do list or earning a badge on a fitness app? That’s gamification at work, my friend.

So why not apply the same principles to saving money? Instead of dreading the sight of your dwindling bank balance, imagine feeling a surge of adrenaline every time you move closer to your savings goal. It’s like leveling up in a video game, except the reward isn’t virtual; it’s cold, hard cash in your pocket.

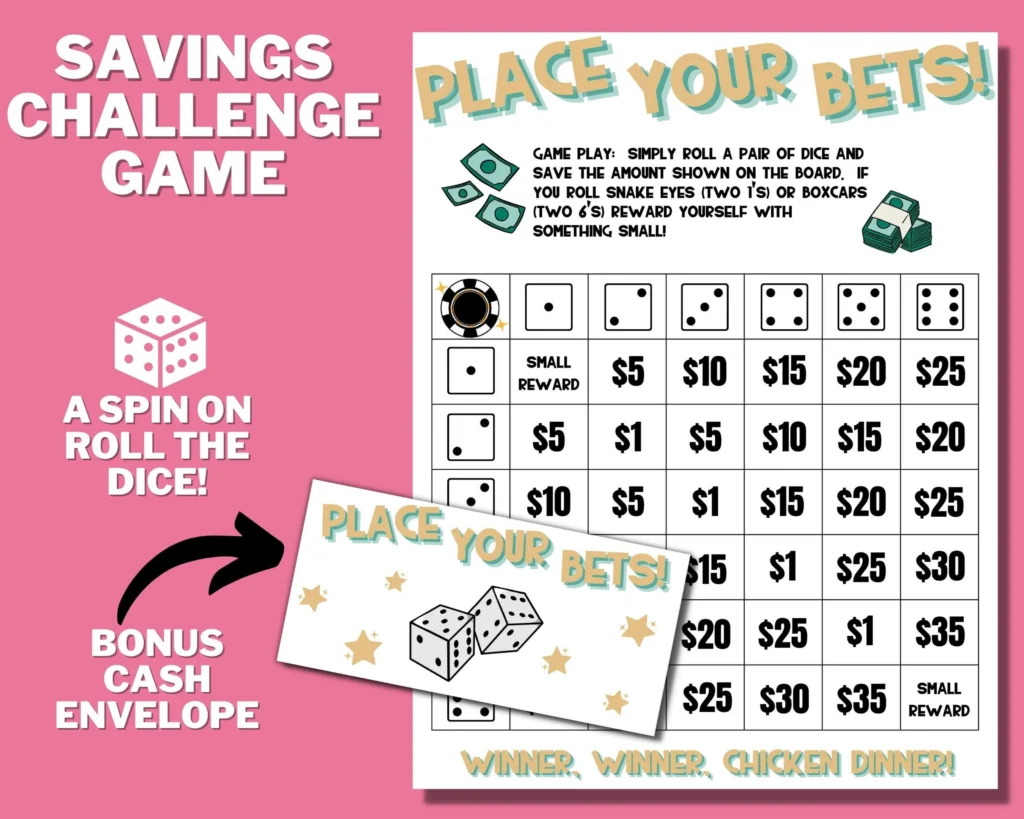

But how exactly do we gamify saving money? Well, the possibilities are endless. From setting challenges and competitions with friends to earning points for every dollar saved, there’s no shortage of ways to make saving fun and rewarding. And the best part? You get to tailor the game to your own preferences and goals. Whether you’re a hardcore strategist or a casual player, there’s a savings challenge out there with your name on it.

Challenge Accepted

Alright, let’s get down to brass tacks. What kind of savings challenges are we talking about here? Allow me to introduce you to a few crowd favorites:

The No-Spend Challenge

This one’s pretty self-explanatory. The goal? To go a certain period of time (usually a week or a month) without spending any money on non-essential items. Think of it as a financial detox for your wallet. Can you resist the urge to splurge? Only time will tell.

Example: Instead of hitting up your favorite clothing store, challenge yourself to mix and match outfits from your existing wardrobe.

The 52-Week Challenge

A classic in the world of savings challenges, this one requires you to save a specific amount of money each week, starting with $1 in week one and increasing by $1 every week thereafter. By the end of the year, you’ll have saved a whopping $1,378 without even breaking a sweat.

Example: Put aside your spare change every Sunday and watch your savings grow week by week.

The Round-Up Challenge

Thanks to modern technology, saving money has never been easier. With round-up apps like Acorns and Qapital, you can automatically round up your purchases to the nearest dollar and invest the spare change. It’s like putting your savings on autopilot.

Example: If you spend $4.50 on a coffee, the app will round up to $5 and invest the remaining $0.50.

The Reverse Budget Challenge

Traditional budgeting can feel restrictive, like being put on a financial diet. But what if we flipped the script? With the reverse budget challenge, you start by setting aside a portion of your income for savings and investments and then spend the rest guilt-free. It’s a game changer, pun intended.

Example: Allocate 20% of your paycheck to savings and investments upfront, then use the remaining 80% for expenses and discretionary spending.

The Debt-Free Challenge

Let’s face it: debt sucks. But with the debt-free challenge, you can turn the daunting task of paying off debt into a game of strategy and perseverance. Set milestones, track your progress, and celebrate each victory along the way. Before you know it, you’ll be shouting “I’m debt-free!” from the rooftops.

Example: Create a visual tracker to monitor your debt repayment progress and reward yourself for reaching each milestone.

The Finish Line

Congratulations, my friend. You’ve made it to the end of our savings adventure. But remember, this is just the beginning. The journey to financial freedom is a marathon, not a sprint. So strap on your running shoes, gather your fellow players, and let’s make saving money the most epic game of all time. Are you ready to level up? I thought so. Now go forth and conquer, and may your bank account be ever bountiful.