Table of Contents

In the fast-paced world of the gig economy, where flexibility and independence reign supreme, millennials and Generation Z are embracing the hustle with open arms.

However, with the freedom of being your boss comes the challenge of managing irregular income.

Budgeting in the gig economy requires a unique approach that combines flexibility and financial discipline.

In this article, we’ll explore practical tips to help millennials and Gen Z navigate the rollercoaster of irregular income and secure their financial future.

Track Your Earnings and Expenses

The first step in mastering the art of budgeting with irregular income is understanding your financial landscape. Keep a meticulous record of your earnings and expenses.

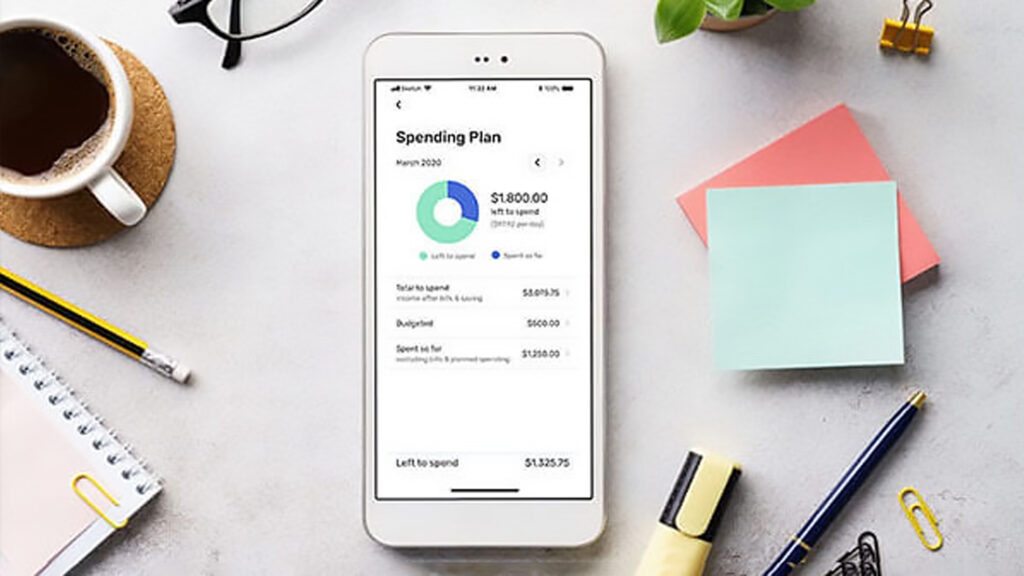

Numerous budgeting apps make this process seamless, allowing you to categorize your income and monitor your spending habits effortlessly. By knowing where your money comes from and where it goes, you can identify patterns and plan accordingly.

Build an Emergency Fund

In a gig economy where work can be unpredictable, having a financial safety net is crucial. Establishing an emergency fund should be a top priority for millennials and Gen Z.

Aim to save three to six months’ worth of living expenses in a separate account. This fund will serve as a buffer during lean months, providing peace of mind and preventing you from dipping into your regular budget.

Create a Bare-Bones Budget

When your income fluctuates, creating a bare-bones budget can be a game-changer. Identify essential expenses such as rent, utilities, groceries, and transportation.

Allocate a fixed amount to cover these necessities and prioritize them over discretionary spending. This minimalist approach ensures that even during low-income periods, you can maintain your financial stability by meeting fundamental needs.

Embrace the Power of Side Hustles

In the gig economy, it’s not uncommon to juggle multiple side hustles to supplement your income.

Explore opportunities that align with your skills and interests, providing an additional income stream. Diversifying your revenue sources can help offset fluctuations in your main gig, creating a more stable financial foundation.

Set Financial Goals

Whether it’s saving for a dream vacation, paying off student loans, or investing in your future, setting clear financial goals provides direction and motivation.

Break down your goals into smaller, achievable milestones. This way, you can celebrate your progress, even during months when your income isn’t as robust.

Prioritize Debt Repayment

For millennials and Gen Z grappling with student loans or credit card debt, prioritizing repayment is crucial. Allocate a portion of your income to systematically tackle high-interest debts.

As your income increases, consider dedicating more of your income to accelerate debt repayment. Eliminating debt not only improves your financial health but also frees up more resources for your financial goals.

Practice Mindful Spending

Irregular income doesn’t mean abandoning the joys of life. Instead, it calls for a more mindful approach to spending. Differentiate between needs and wants, and allocate funds accordingly.

Consider adopting the 50/30/20 rule, where 50% of your income covers necessities, 30% goes to discretionary spending, and 20% is earmarked for savings and debt repayment.

Negotiate and Adjust

In the gig economy, opportunities for negotiation are abundant. Whether it’s setting your freelance rates or negotiating expenses with clients, don’t hesitate to advocate for fair compensation.

Additionally, remain flexible in adjusting your budget as circumstances change. Regularly review your financial plan and make necessary adjustments to accommodate shifts in your income or expenses.

Conclusion

Budgeting for irregular income in the gig economy requires a blend of strategic planning, discipline, and adaptability.

By tracking your finances, building an emergency fund, creating a bare-bones budget, embracing side hustles, setting goals, prioritizing debt repayment, practicing mindful spending, and staying open to negotiation, you can navigate the challenges of irregular income while building a solid financial foundation for the future.

As millennials and Gen Z continue to shape the landscape of work, mastering the art of budgeting is an essential skill that ensures financial well-being and peace of mind.

The content on Freedom With Cents is provided for informational and educational purposes only. We make no representations or warranties regarding the accuracy, completeness, applicability, or fitness of any information published on this site. The articles and materials are not intended to serve as legal, tax, financial, investment, or professional advice of any kind.

Nothing contained on this website constitutes a solicitation, endorsement, or offer to buy or sell any financial products, services, securities, or other instruments. All content is general in nature and may not be suitable for your personal financial situation or goals.

You should consult with a qualified professional before making any financial decisions based on information provided here. You are solely responsible for evaluating the risks and outcomes associated with any actions you take based on our content.